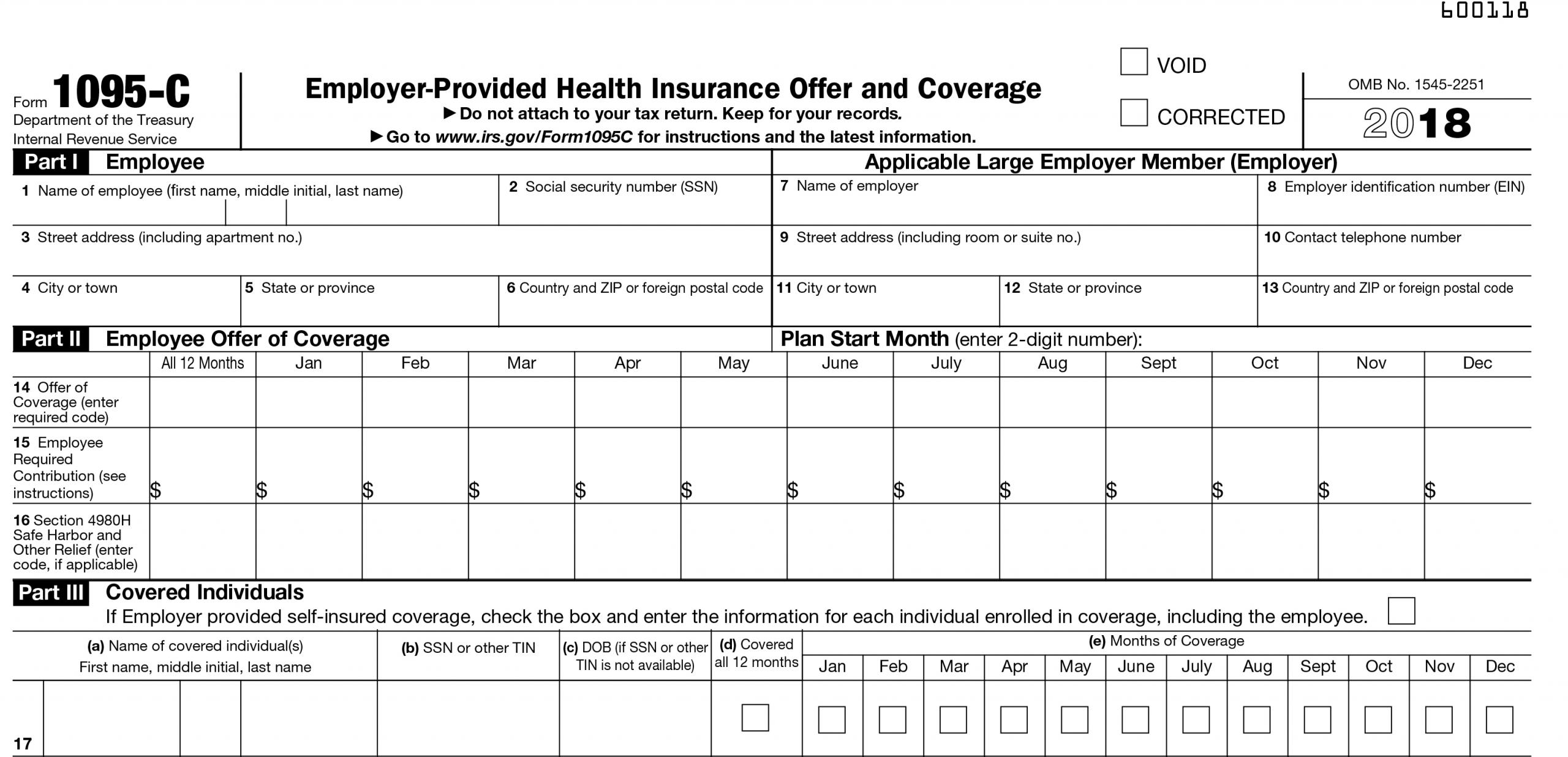

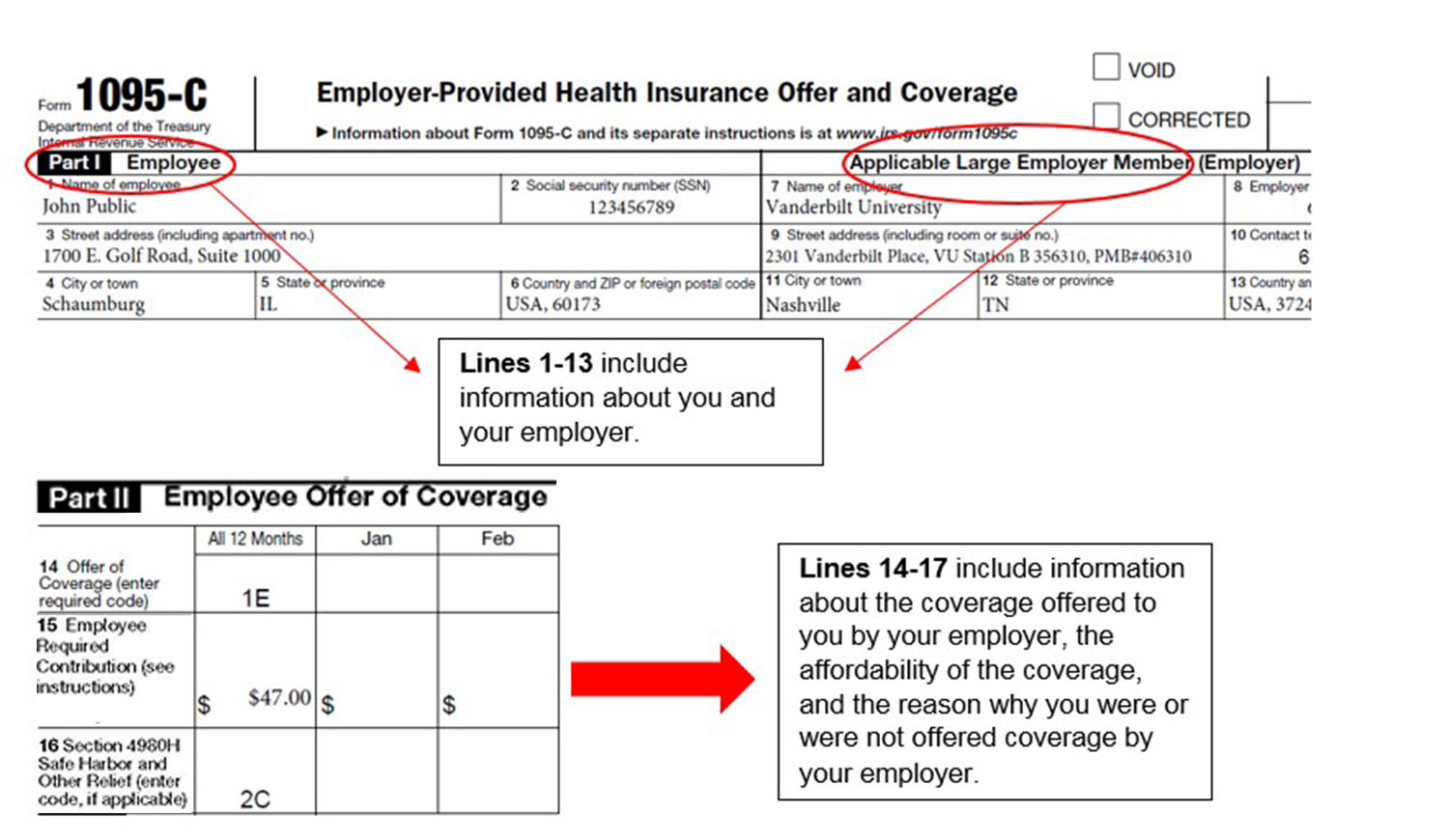

1095C Form Download ACAPrime "C Forms" Template Download ACAPrime "B Forms" Template Check out the details for ACA reporting for employers by Individual US State ACAPrime Template Tutorial (12 min) Video is for C Forms Be sure to click the Full Screen Box to the bottom right for optimal viewing ACA Reporting Reference Guide Mbwl employer's guide to acaForm 1095C, EmployerProvided Health Insurance Offer and Coverage The Affordable Care Act (ACA) requires our company to provide employees, if applicable, with a Form 1095C, EmployerProvided Health Insurance Offer and Coverage Form 1095C would be applicable to you if You were eligible and were offered the Minimum Value Plans anytime in or;You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, Part

What You Need To Know About Aca Annual Reporting Aps Payroll

1095 c form 2020 due date

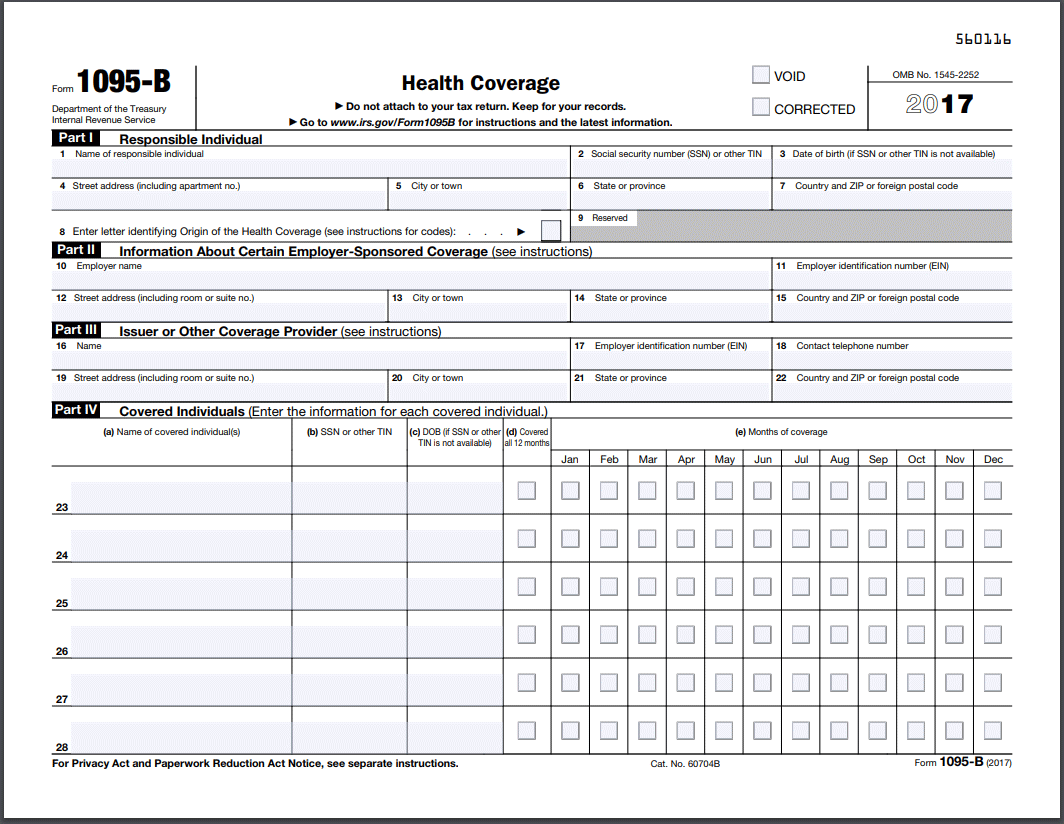

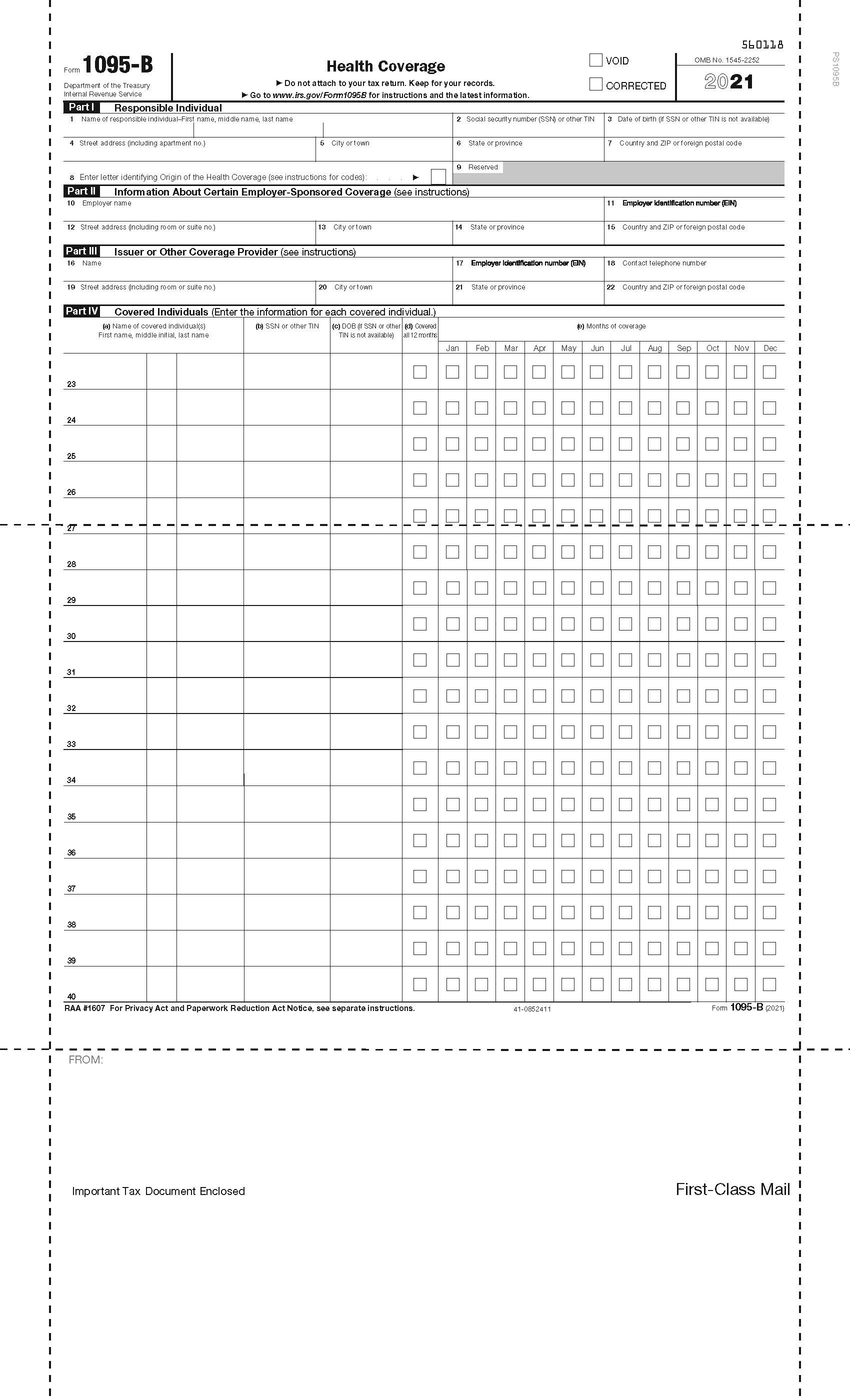

1095 c form 2020 due date- Form 1095B This version of Form 1095 is sent by health insurance providers to individuals they cover Employees enrolled in UC's Kaiser or UC Blue & Gold (Health Net) plan in receive this form from their plans Form 1095C This version of Form 1095 is sent by employers UC sends this form to UC employees if theyThe Form 1095C contains important information about the healthcare coverage offered or provided to you by your employer Information on the form may be referenced when filing your tax return and/or to help

1095 C Form 21 Finance Zrivo

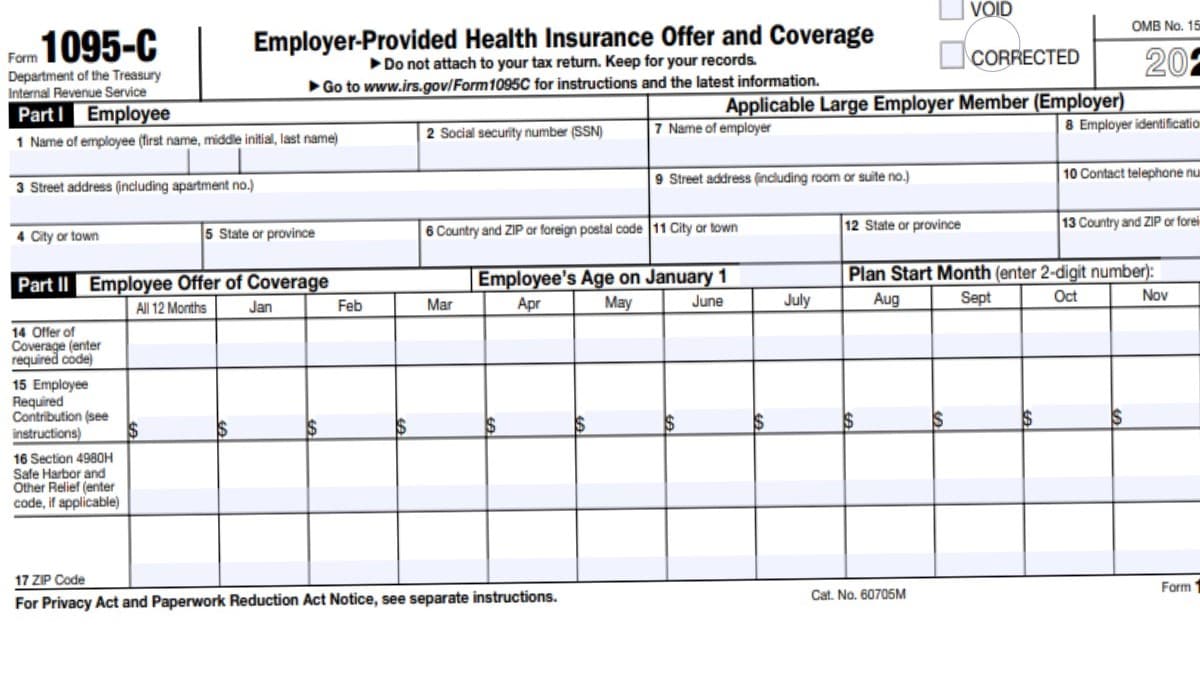

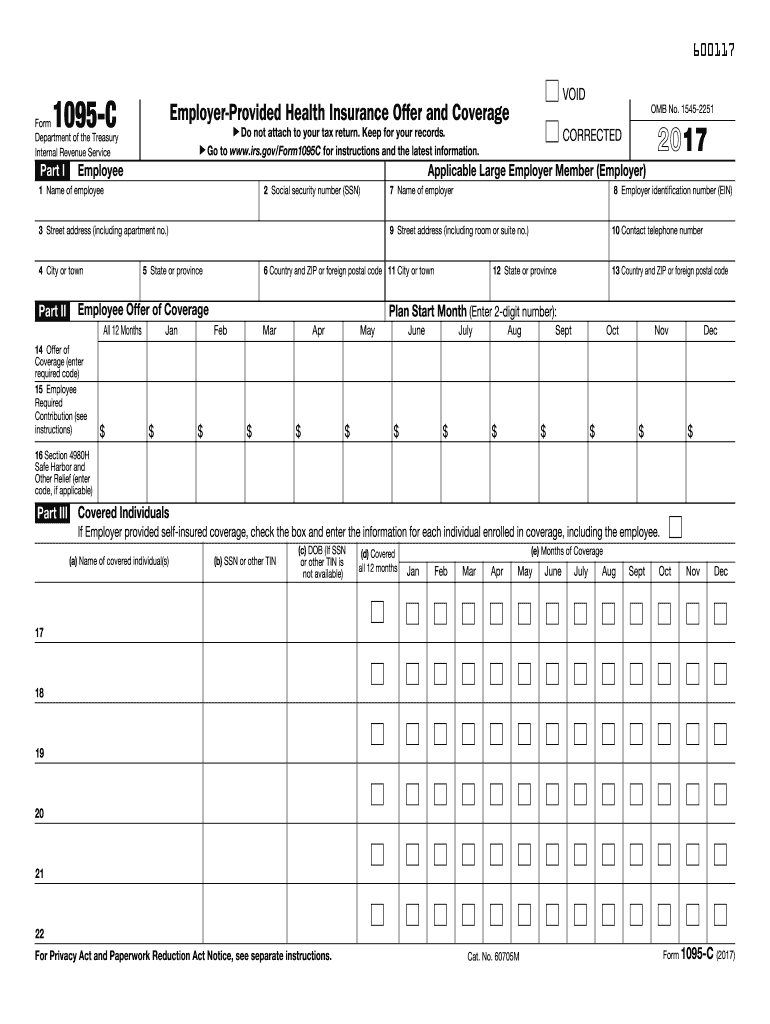

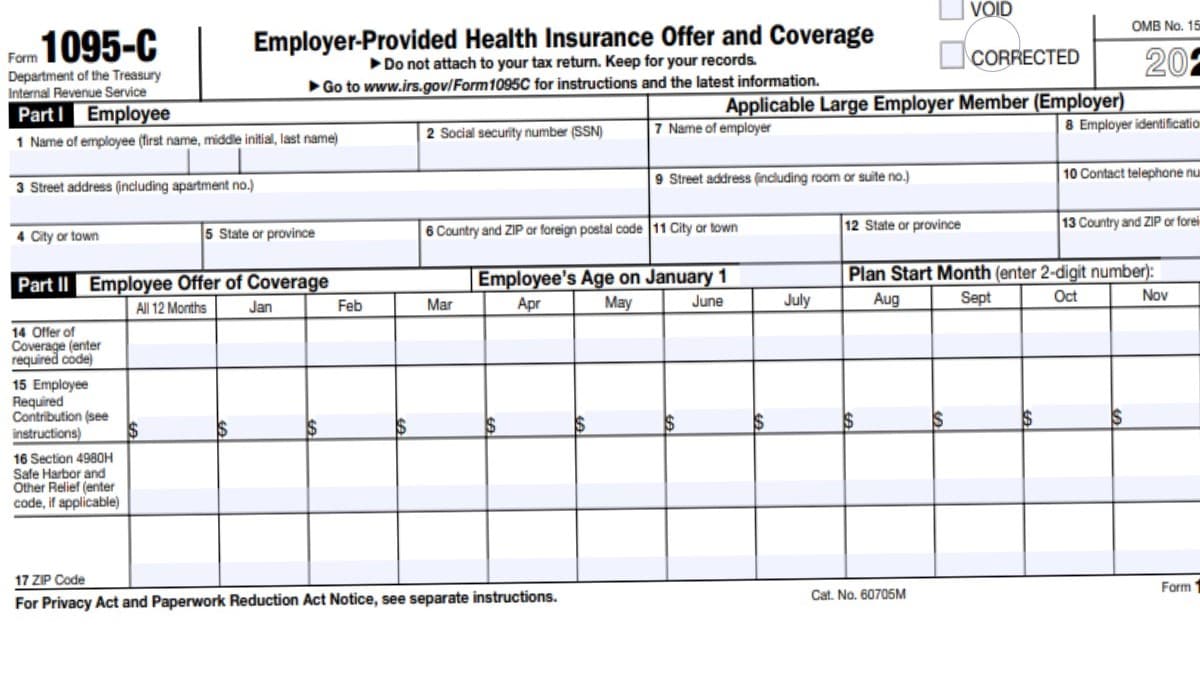

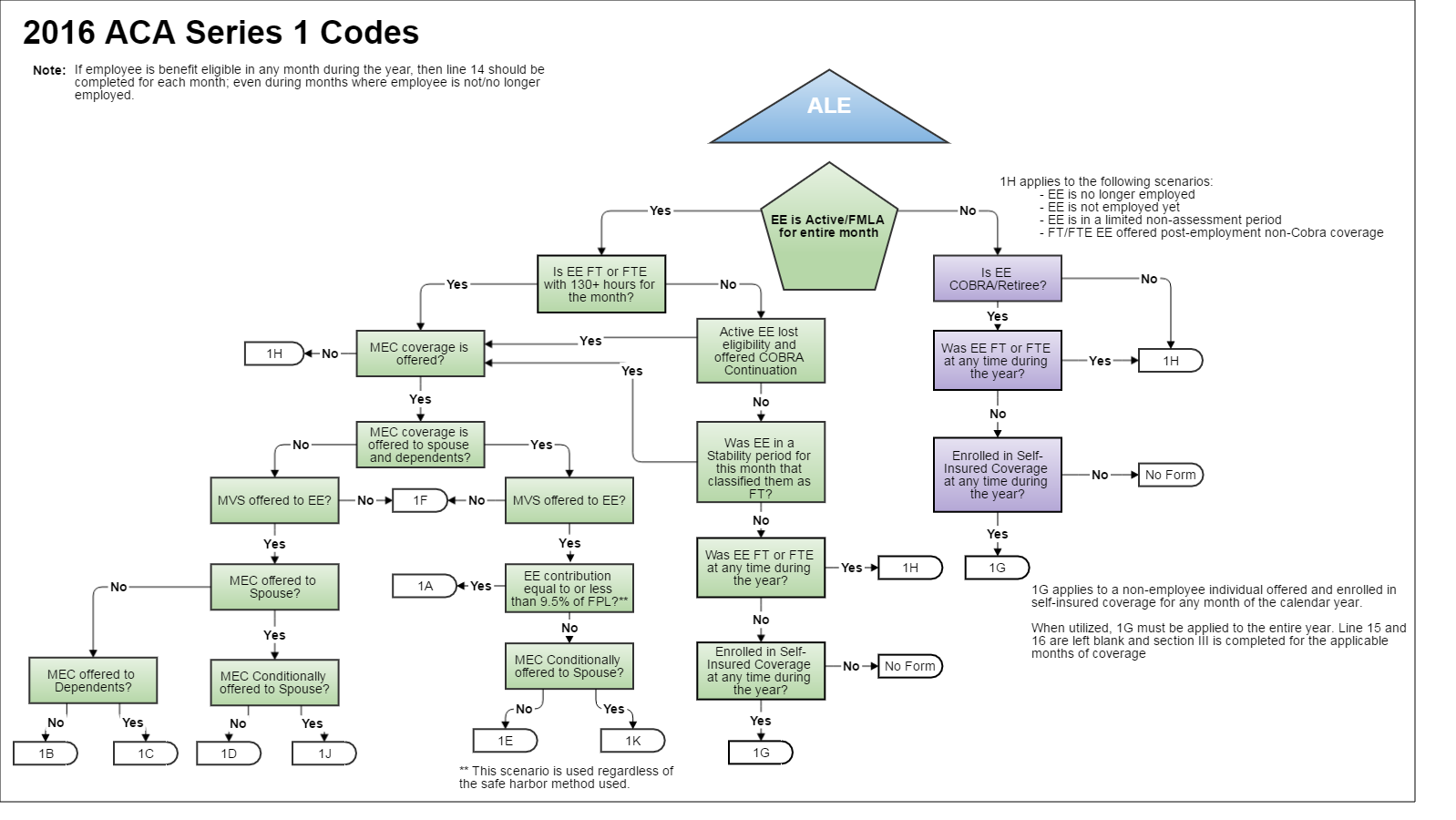

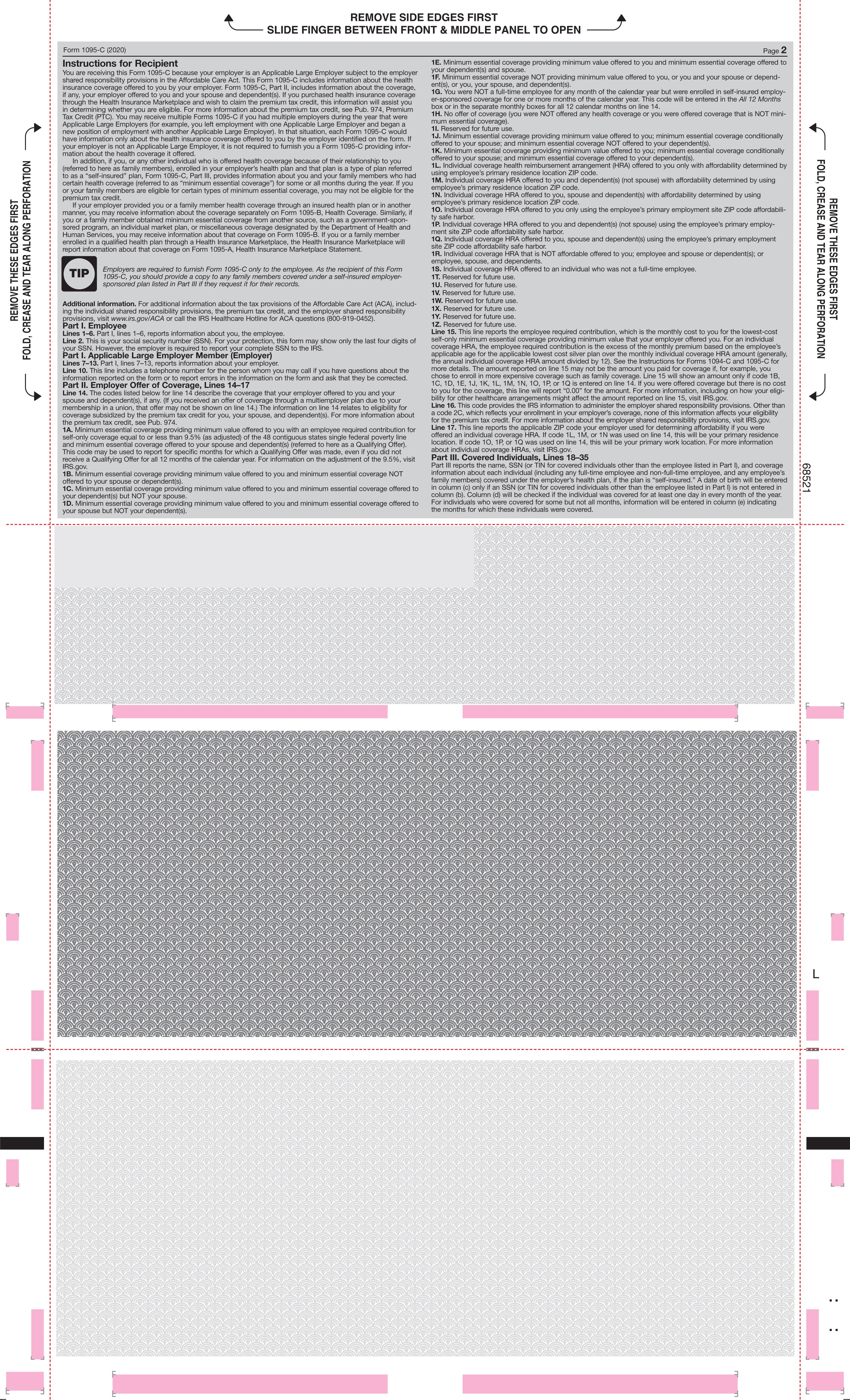

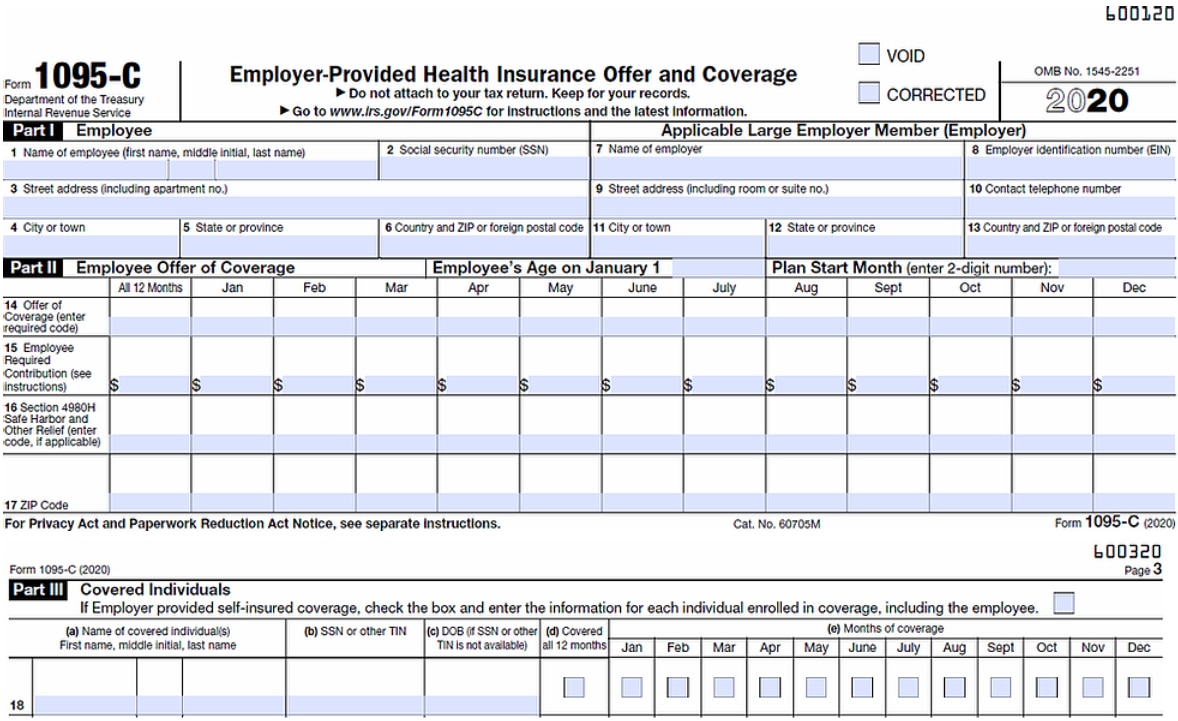

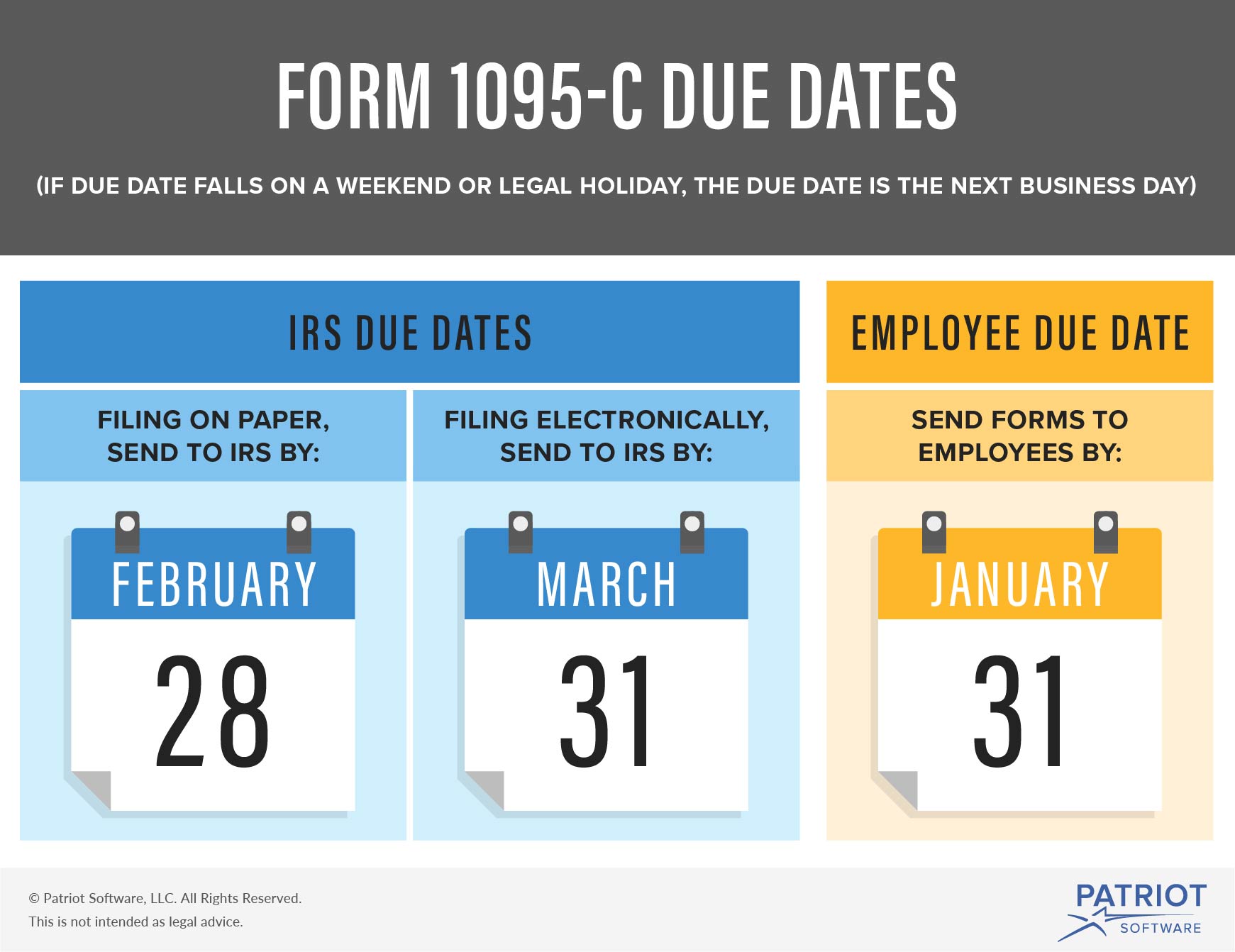

0511 Line 15 on the 1095C is for the employee required contribution Line 15 is only required if you entered code 1B, 1C, 1D, 1E, 1J, 1K, 1L, 1M, 1N, 1O, 1P, 1Q, 1T, 1U on line 14The due date for furnishing Form 1095C to individuals is extended from , to See Notice 76 and Extensions of time to furnish statements to recipients Relief for failure to furnish statements to certain employees enrolled in selfinsured health planEmployers have until January 31 to send the form to their employees Thus, a 1095C form will be sent in early January 21 The IRS expects every ALE to send in a completed 1095C printable form for each eligible employee by the end of February If they choose to fill out the statement electronically, the IRS allows them to submit a 1095C online form

IRS Notice 76 extended the due date for furnishing Form 1095C to individuals from to 3/2/21 6 Will my covered spouse and/or dependents receive their own Form 1095C?CODES FOR IRS FORM 1095C CODE SERIES 1 (continued) 1J Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage conditionally offered to spouse; On Oct 2, , the IRS announced it would extend the deadline for employers to provide employees with a copy of their 1095C or 1095B reporting form, as required by the ACA, from Jan 31, 21

Related Forms 1095C Ever since mailing out a 1095C tax form was made compulsory in the 15 fiscal year, all ALEs are required to send these statements not only to their eligible employees but also to the IRS What are the Form 1095C deadlines? Affordable Care Act Forms 1095C and 1095B About the Form 1095C The Office of the Comptroller will mail paper Forms 1095C (Affordable Care Act) by the end of February Forms 1095B and 1095C should be kept with tax records1095 c form 19 ;

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

2

Form 1095C must be provided to the employee and any individual receiving MEC through an employer by January 31 of the year following the calendar year to which the return relates Extensions – No penalty will be imposed for federal Forms 1094C and 1095C filed with the FTB on or before May 31 FTB Pub 35C (NEW ) Page 3 Where To File Send allForm 1095C contains information about the health coverage offered by your employer in This may include information about whether you enrolled in coverage Use the information contained in the 1095C to assist you in determining in you are eligible for the premium tax creditMinimum essential coverage not offered to dependent(s) (See Conditional offer of spousal coverage, for an

Updated Hr S Guide To Filing And Distributing 1095 Cs Bernieportal

Affordable Care Act Aca Forms Mailed News Illinois State

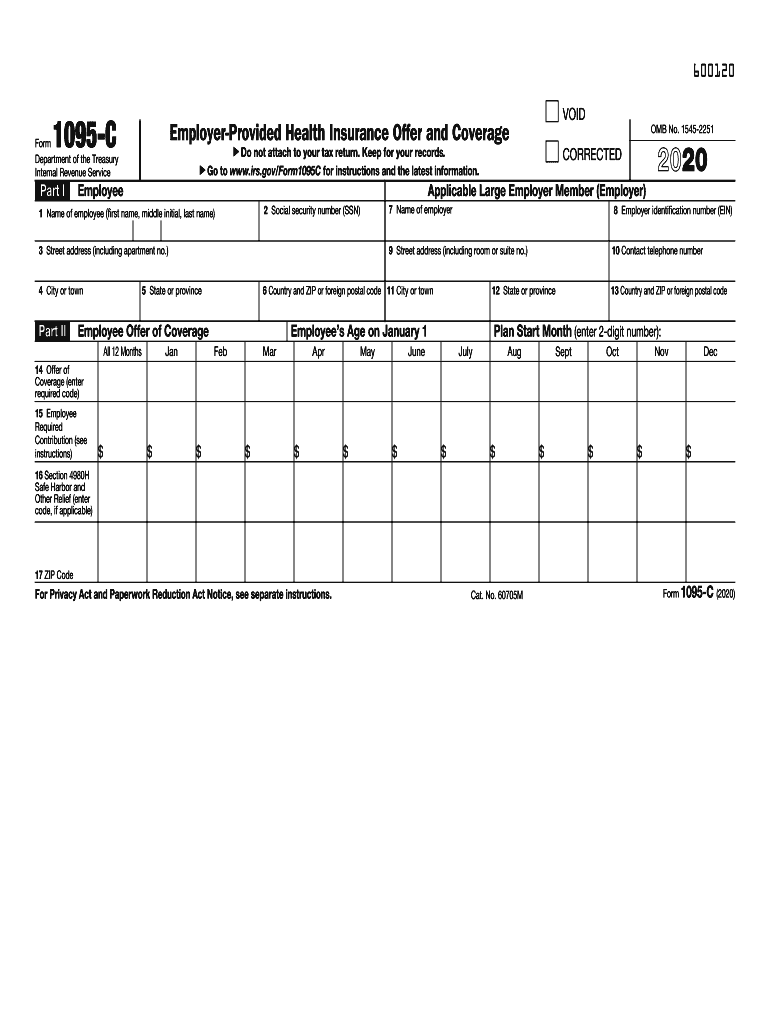

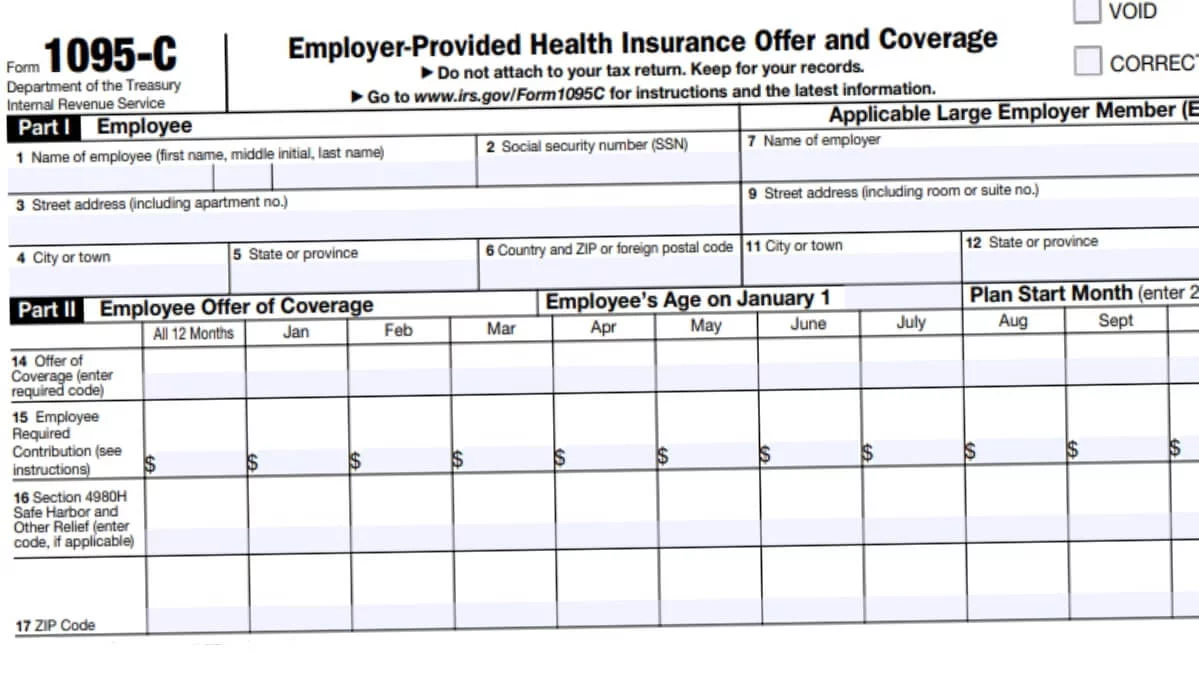

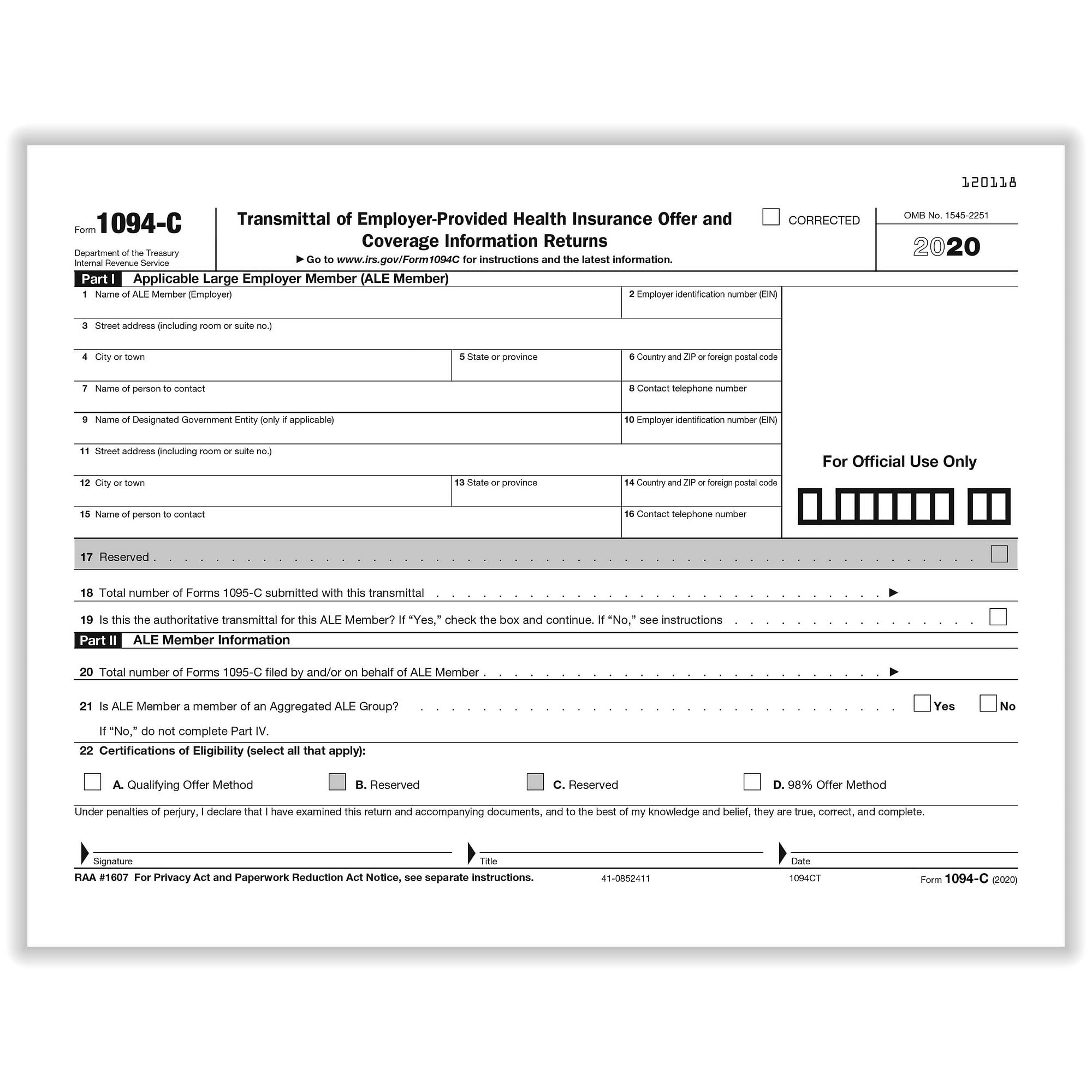

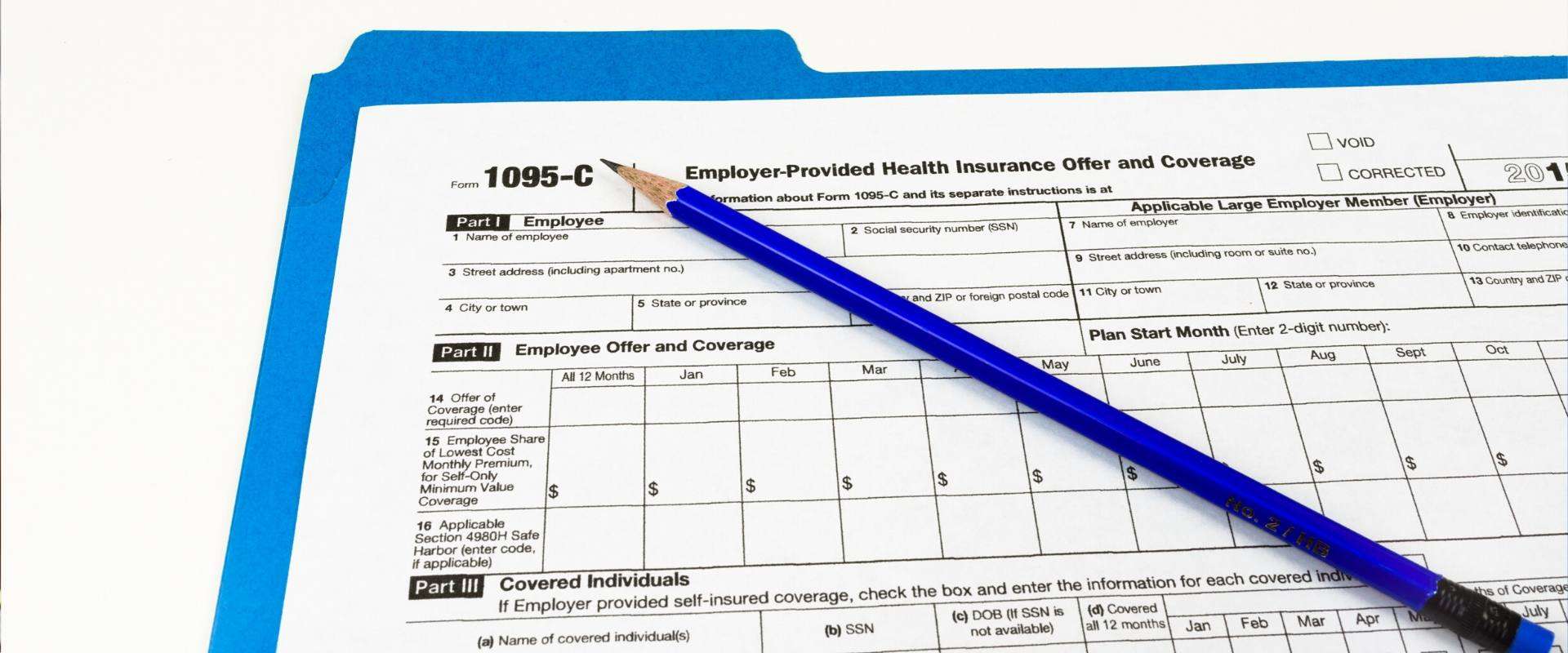

How do I complete line 15 on the 1095C form?Filling out Form 1095C 1 – Part I (Employee) A form needs to be completed for each individual you employed fulltime for at least one month during the past year and any nonfulltime employees who enrolled in health insurance through your company (Name, SSN, and address are required) 2 – Line 713 Employer name,Online solutions help you to manage your record administration along with raise the efficiency of the workflows Stick to the fast guide to do Form 1094C, steer clear of blunders along with furnish it in a timely manner How to complete any Form 1094C online On the site with all the document, click on Begin immediately along with complete for the editor Use

17 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

2

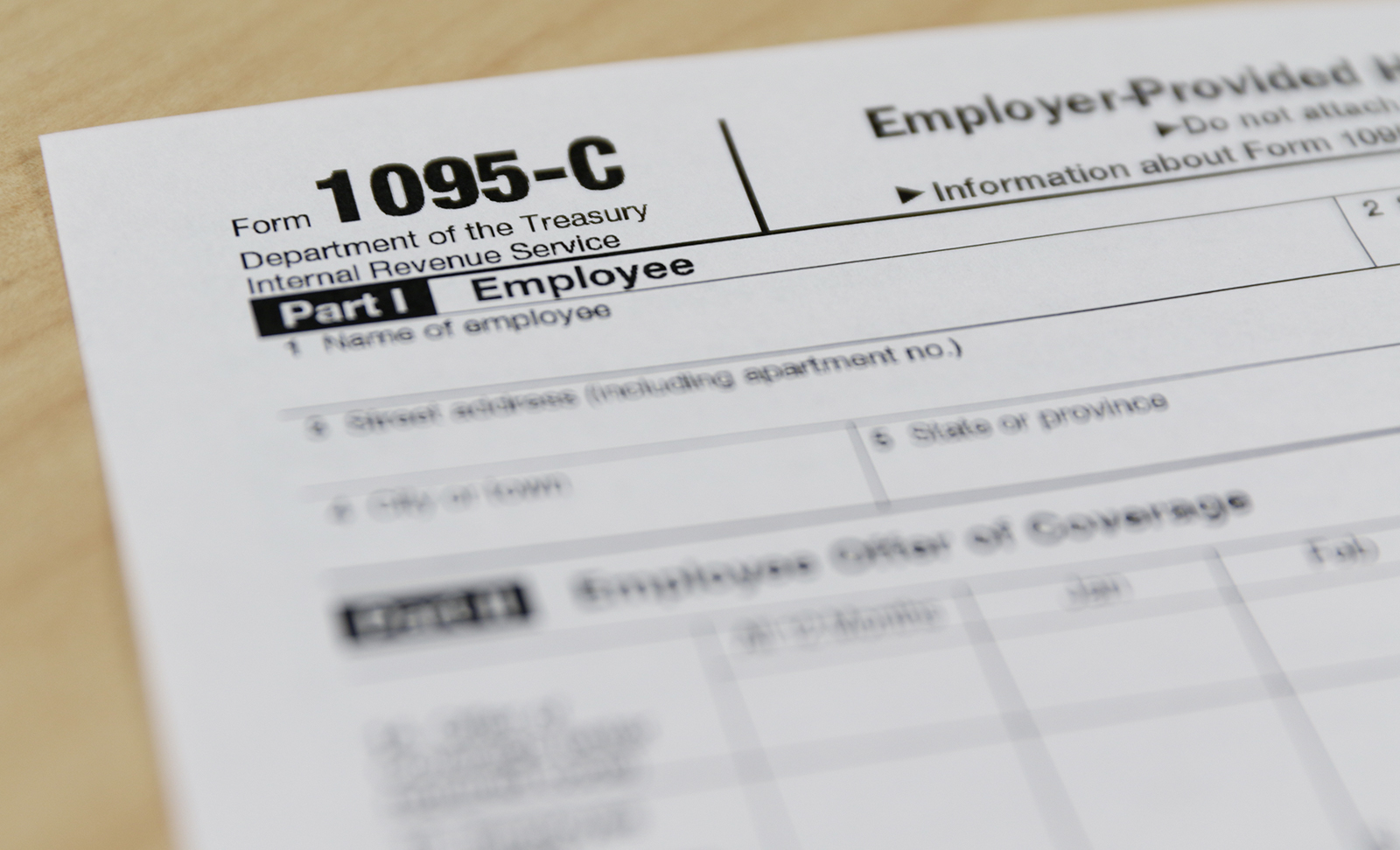

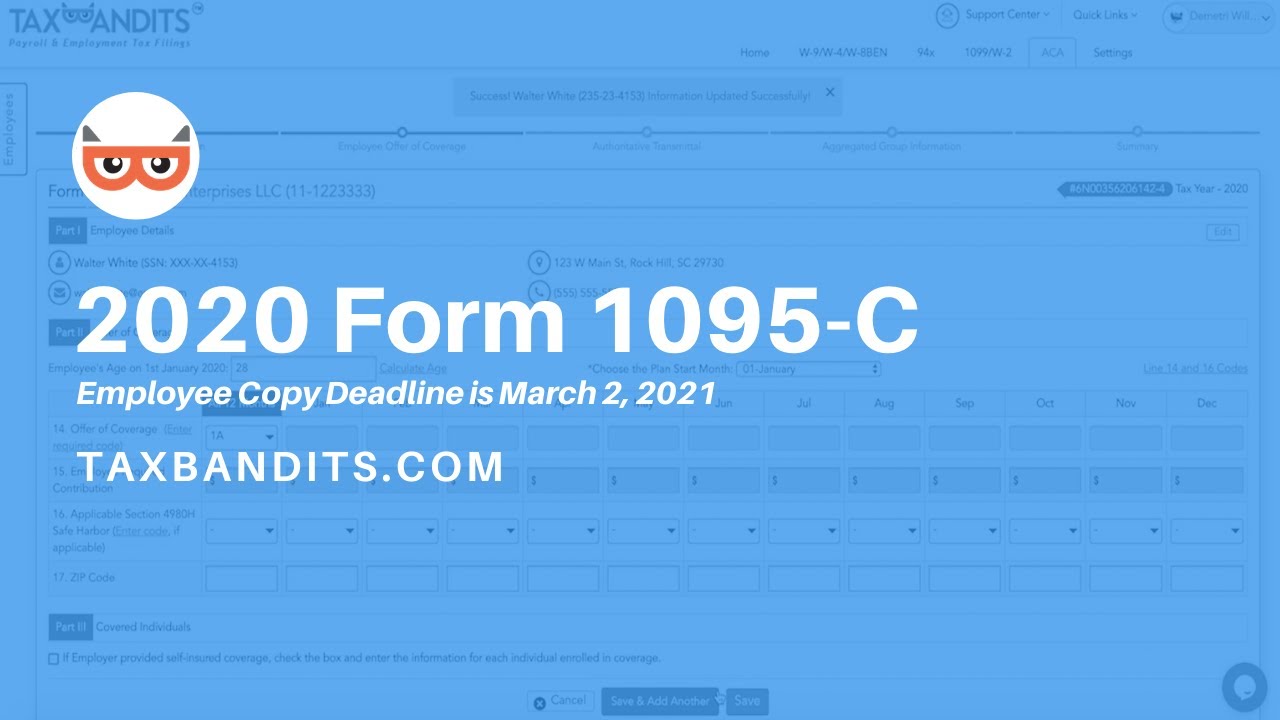

Instructions for Forms 1095C TaxBandits The Form 1095C is the EmployerProvided Health Insurance Offer and Coverage, designed by the IRS toThere is no longer a federal mandate to have health insurance and you do not have to file Form 1095C on your Tax return Prepare and eFile Your Taxes here on eFilecom 1095C If you and/or your family receive health insurance through an employer, the employer will provide Form 1095C by early March 21 The purpose of Form 1095C is to provide you the information you need to know about claiming the premium tax credit, reconcile the credit on your tax return with advance payments of the premium tax credit and file your federal income tax return Content of Form 1095C Form 1095C is made up of two parts On Part I, you will see information about you and your employer It will

Irs Form 1095 C Uva Hr

Form 1095 And The Aca Office Of Faculty Staff Benefits Georgetown University

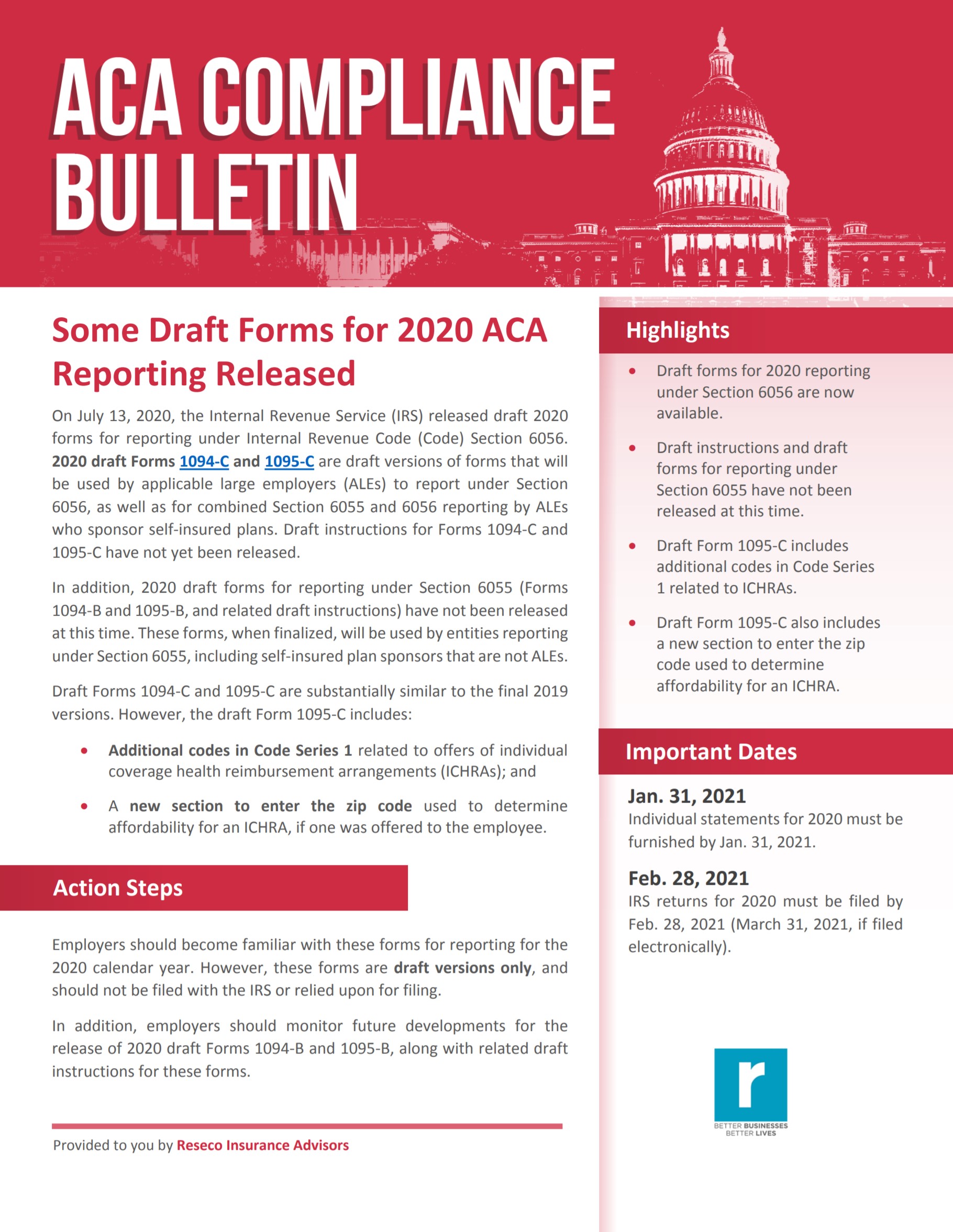

For the tax year , there is a change in the 1095C due date New lines and codes are also released by the IRS Usually, the deadline to furnish employee copies is January 31 This year, the deadline is extended to Updated 1095C Employer Reporting Guide The IRS recently provided the final 1095C employer reporting forms and instructions The 1095C forms were modified slightly, primarily to facilitate reporting by employers who offered individual coverage HRAs (ICHRAs) in The Form 1094Cs are pretty much identical to last yearBy Joshua Allen By , Missouri State University is required to furnish all fulltime employees with a Form 1095C What is a Form 1095C?

1095 C Form Health Coverage The Supplies Shops

Some Draft Forms For Aca Reporting Released Resecō

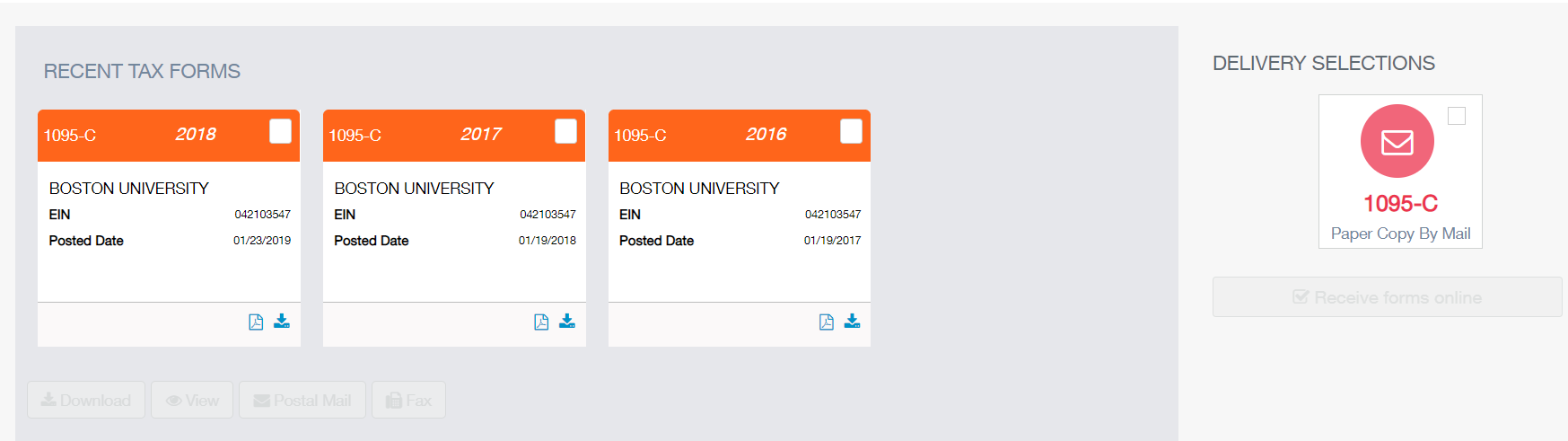

Your 1095C Tax Form for You will soon receive your 1095C via US Mail for the tax year containing important information about your health care coverage Employers are required to provide the 1095C to the following employees as part of the Patient Protection and Affordable Care Act Employees enrolled in the Boston University Health Plan at any point in ;While you will not need to include your 1095C with your tax return, or send it to the IRS, you may use information from your 1095C to help complete your tax return The Affordable Care Act requires certain employers to send Form 1095C to fulltime employees and their dependents This form contains detailed information about your health care coverage If you received an Advance The Codes on Form 1095C Explained Robert Sheen Affordable Care Act 3 minute read Every year Applicable Large Employers ("ALEs") must file Forms 1094C and 1095C with the IRS and furnish Forms 1095C to employees considered fulltime under the Affordable Care Act ("ACA")

Www Opm Gov Healthcare Insurance Fastfacts Health Coverage Forms Fast Facts Employees Pdf

Form 1095 C Basics Best Practices And Hr Compliance Bernieportal

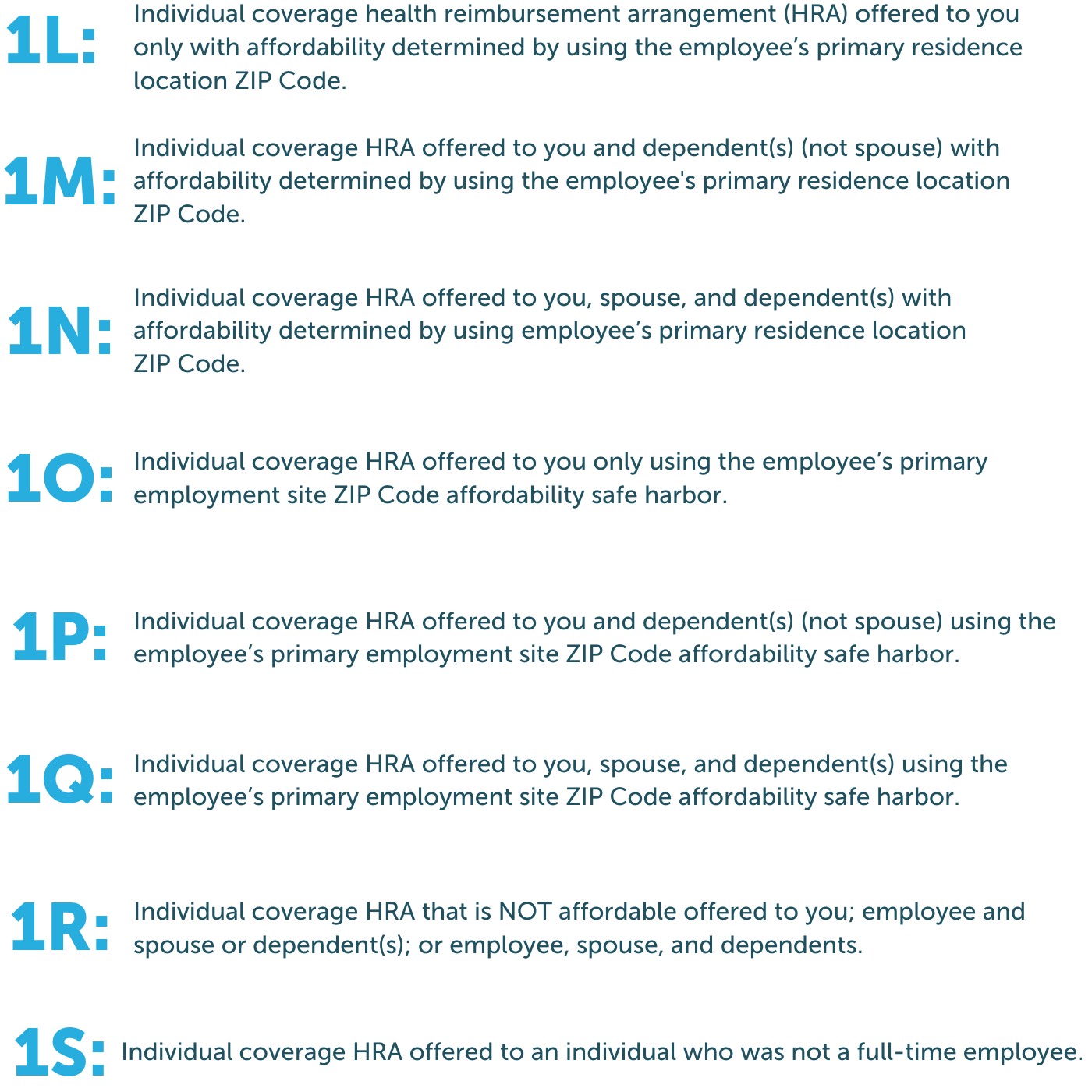

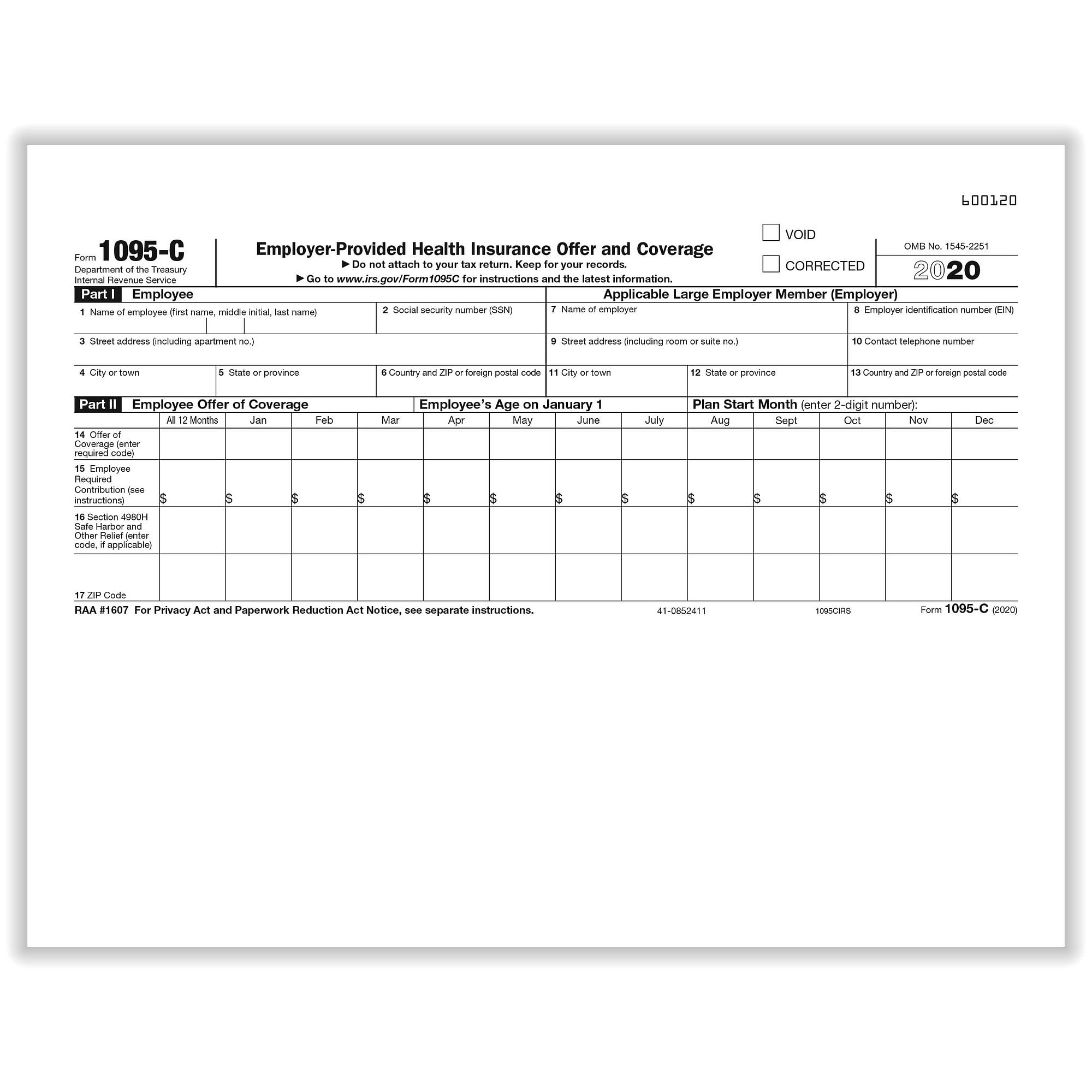

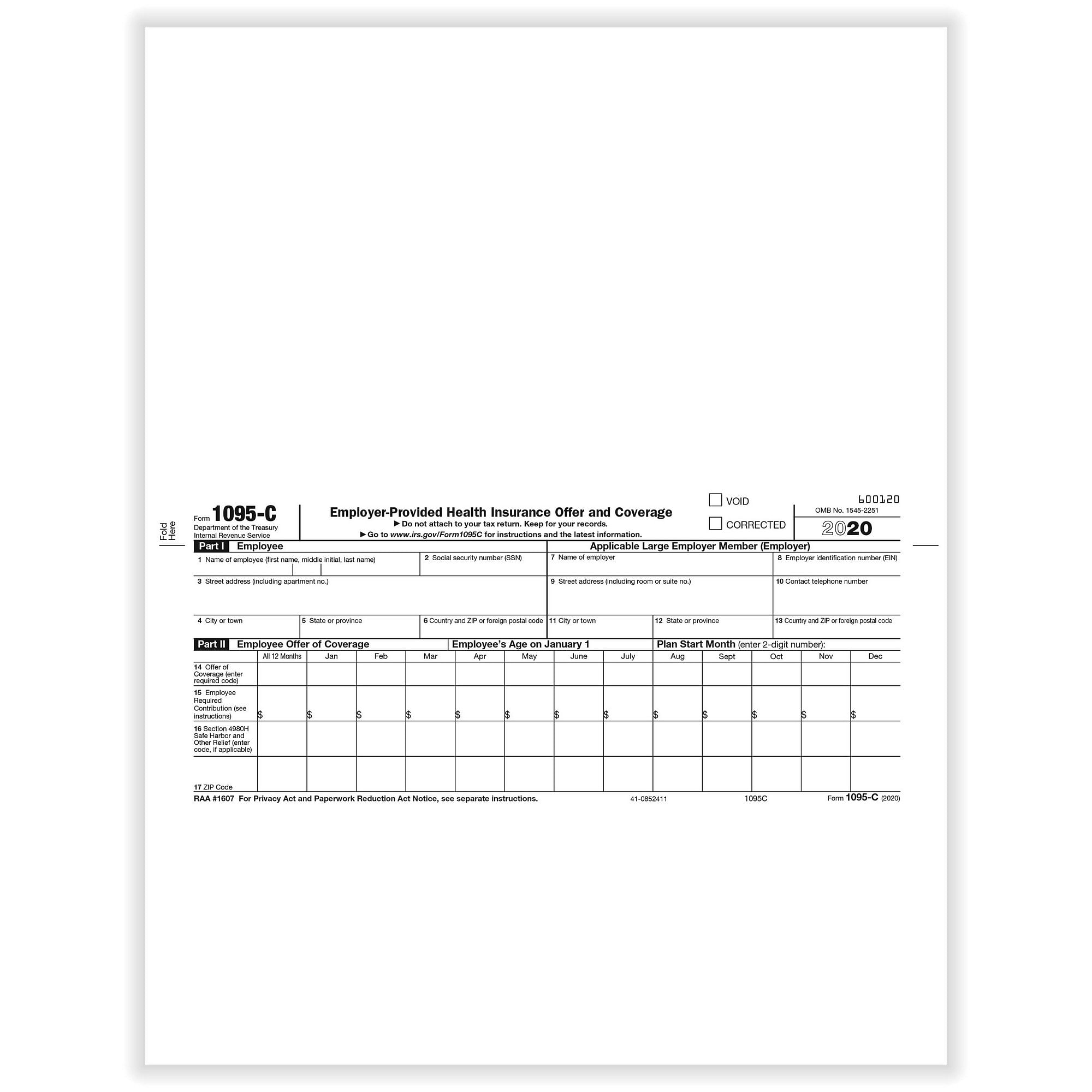

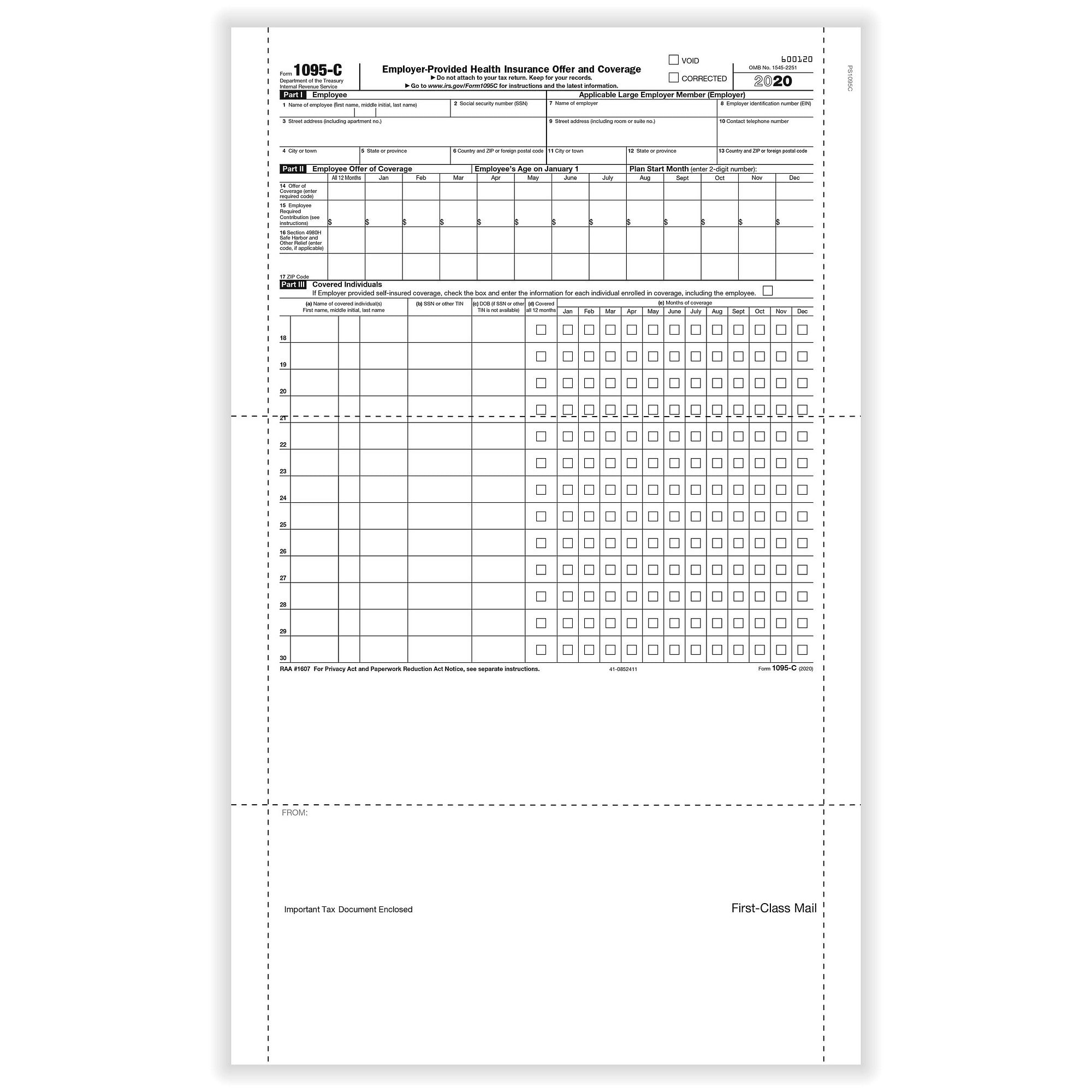

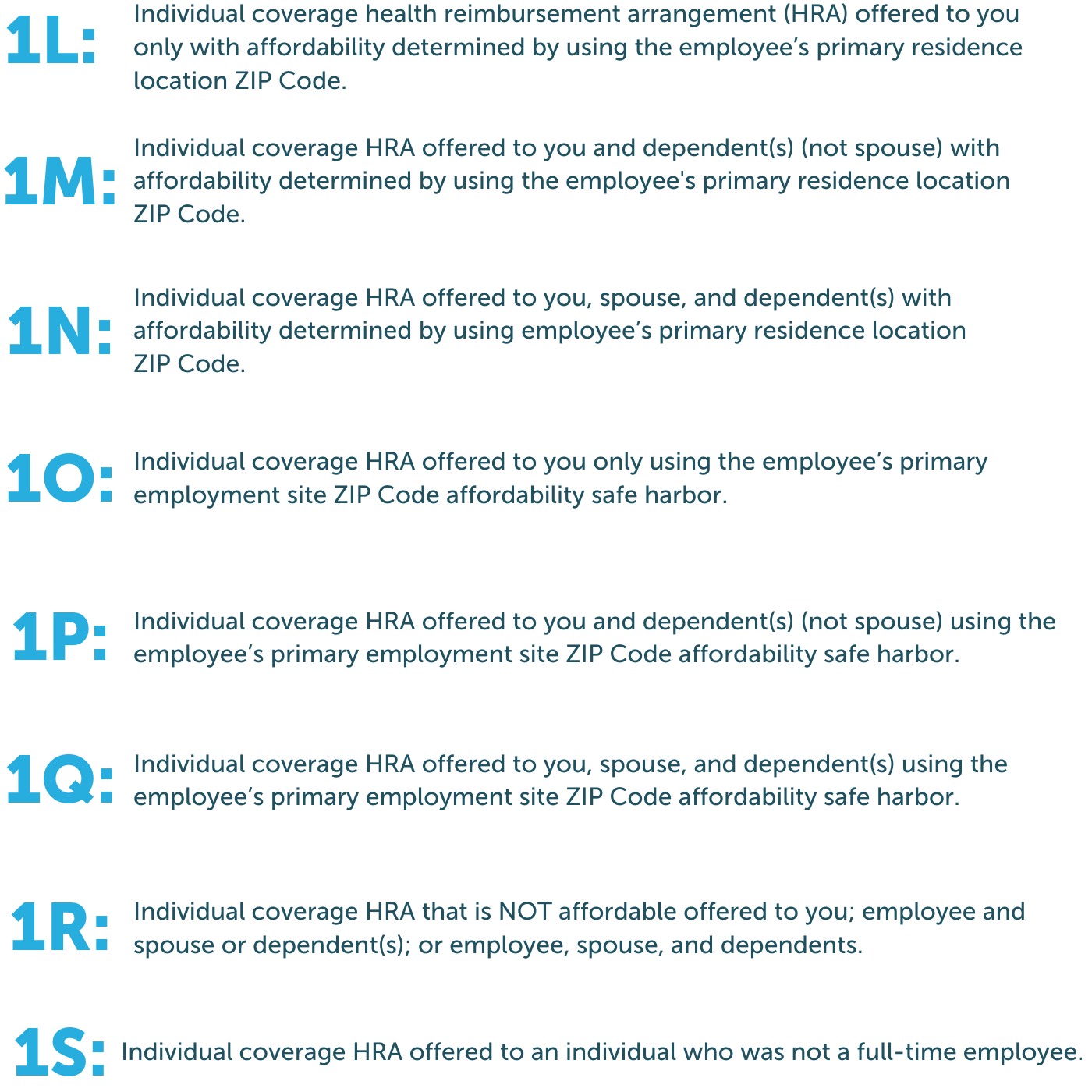

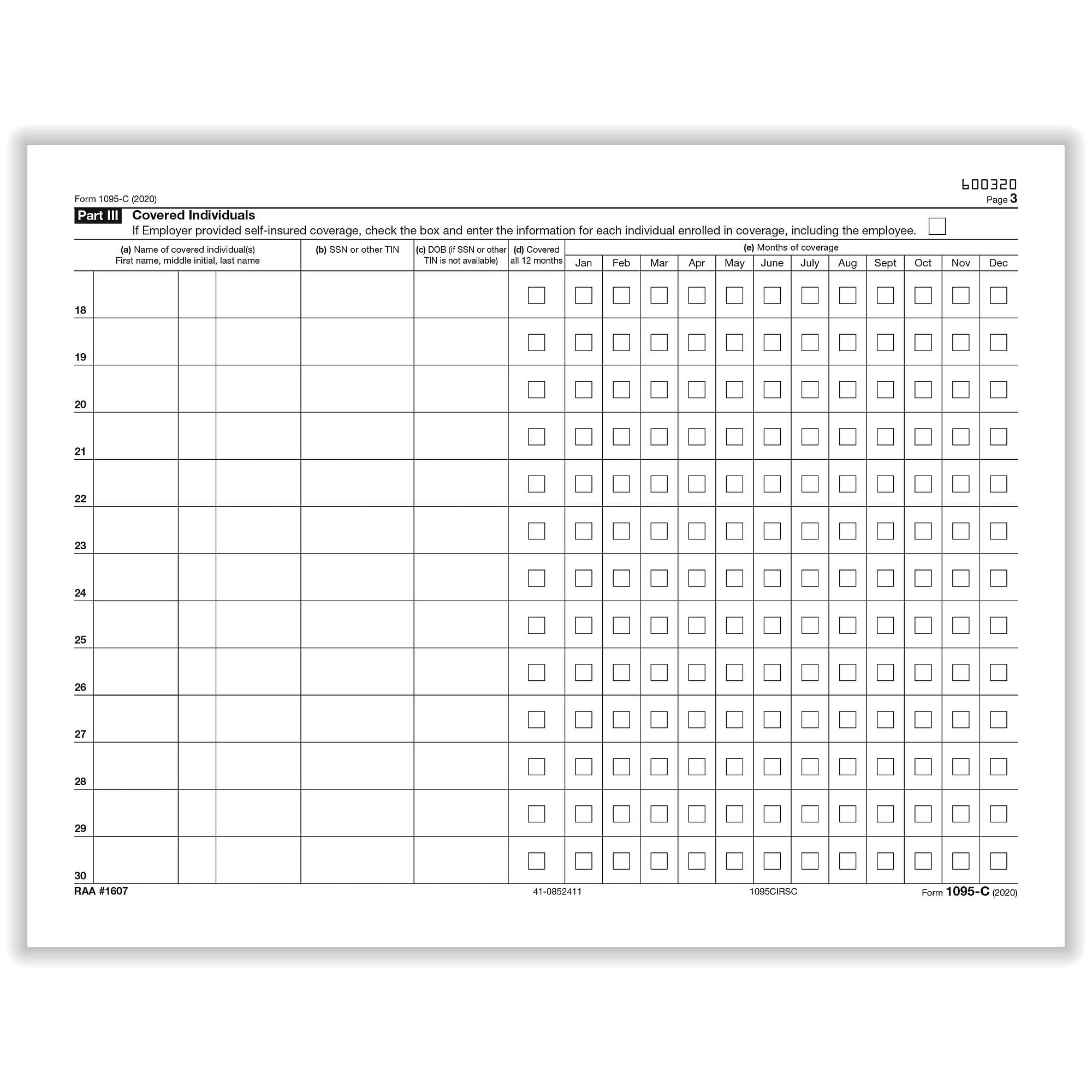

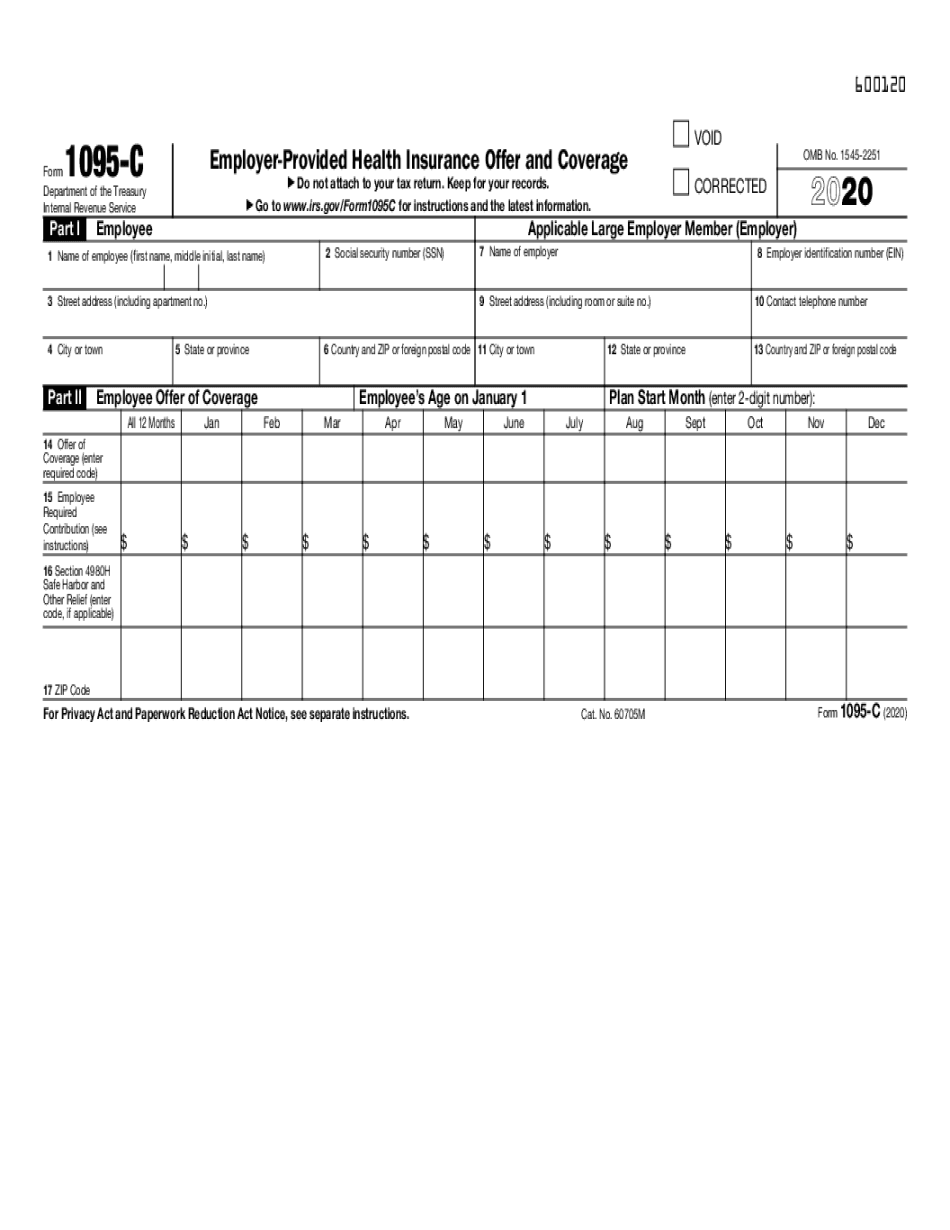

The Form 1095C must be postmarked by The 1095C documents your health care election for Employees will only receive a 1095C from the district if you are benefit eligible The Affordable Care Act states that all employees who regularly work 30 hours or more are eligible for medical benefits If you have any questions, please contact us at benefits2@psd2org Sample Excel Import File 1095C xlsx What's New for In Part 2, added field "Employee's Age on January 1" before the Plan Start Month field New codes for line 14 "Offer of Coverage" 1L, 1M, 1N, 1O, 1P, 1Q, 1R, 1S New field, line 17 "Zip code"

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

1

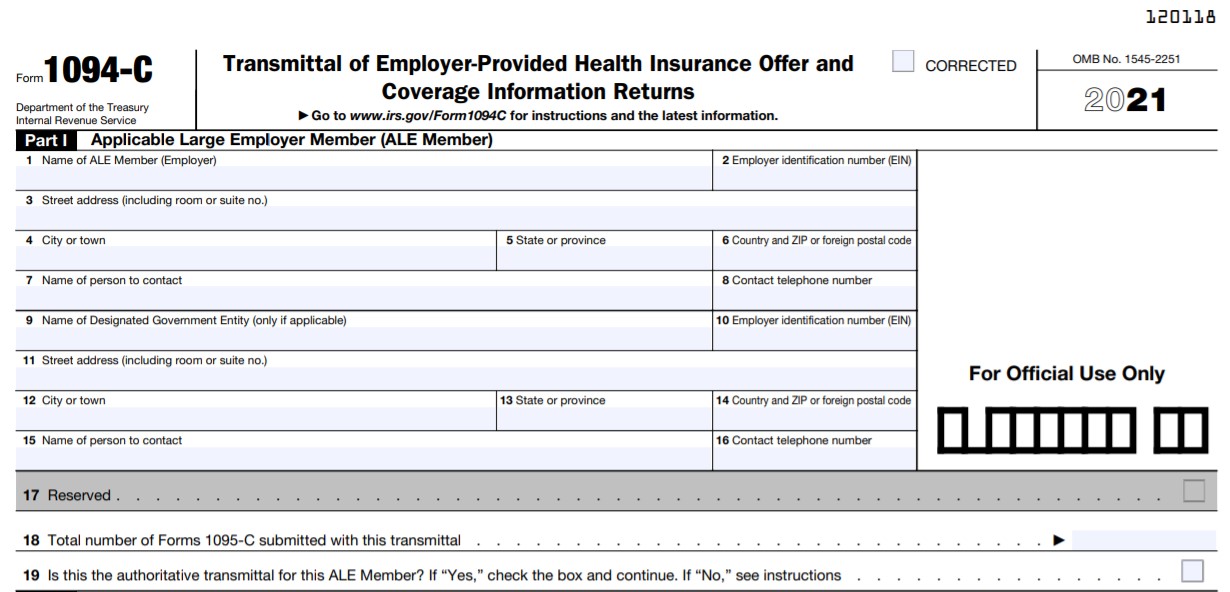

Final Form 1094C Final Form 1095C Employers, if you are unsure of the coding on your ACA information returns and need assistance in carrying out these responsibilities, as required by the ACA's Employer Mandate, contact us to learn about how ACA Complete can help For information on ACA penalty amounts, affordability percentages, important filing deadlines, The remainder of the article discusses the changes made to the iteration of the Form 1094C and 1095C instructions Changes That Apply to All Employers Plan Start Month The largest change made to the instructions is the plan start month box will need to be completed In previous years the plan start month box was optional so most employers elected not to 1095C I think I'm getting fined I have Covered California from July to Dec (1095A Form), my previous employer sent me 1095C for Jan to May but there is no where I can enter on Turbo Tax I heard if you don't have health insurance for 3 months you are fined

Updated Irs Reporting Requirements Babb Insurance

2

Much like the Form W2 is used to determine whether or not you owe taxes, the IRS will use the information reported from your Form 1095C to confirm healthcare coverage Think of the form as your "proof of insurance" for the IRS If you enrolled in healthcare coverage at any time in , you will receive a Form 1095C from the CollegeWhat are the recent updates on Form 1095C?File 1095C Online with Tax1099 for easy and secure eFile 1095C form IRS authorized eFile service provider for Payroll Tax form 1095C How to file 1095C instructions

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Other Recent Form 1095C Changes to Filing Instructions In , the IRS introduced a handful of other changes to ACA reporting forms These included Plan Start Month All Applicable Large Employers (ALEs) must enter a twodigit code on Form 1095C Age and ZIP Code Inclusion If an employee was offered an ICHRA, employers must enter theInst 1094C and 1095C Instructions for Forms 1094C and 1095C 16 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 15 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 14 Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C Changes Coming for Form 1095C On , the Internal Revenue Service (IRS) provided a draft that shows changes to the tax forms for Rest assured Tango is reviewing and preparing to comply with the changes The 1094C form that gets transmitted to the IRS and shows the overall compliance for an EIN remains the same

Oklahoma Gov Content Dam Ok En Omes Documents Faq Irs1095creporting Pdf

Www Utdallas Edu Hr Download Irs Form 1095 C Faq Pdf

You will need this information when completing your Federal tax return If you were working an average of 30 or more hours per week in and/or were enrolled in one of the Harvard health plans at any time in , you will receive a Form 1095C When will I received my Form 1095C? 1095C Tax Form for Before eligible employees will receive a Form 1095C tax document, which reports information about your medical coverage in While you will not need to include your 1095C with your tax return filing, or send it to the IRS, you may need information from your 1095C to help complete your tax returnIRS Form 1095C is used by Applicable Large Employers (ALEs) to report the health insurance coverage information provided to their fulltime employees and employee's dependents For the tax year , form 1095C has been updated And, employers should use the updated 1095C form to file with the IRS this year

1095 C Tax Forms Cwi

2

What are the Form 1095C deadlines? Earlier in October , the IRS also announced an extension of the furnishing deadline for Forms 1095B and 1095C The distribution deadline is now The typical 30day extension to furnish information statementsForm 1095C is not required to be filed with your tax return If you had fullyear coverage for , no action needs to be taken with Form 1095C If you did not have fullyear coverage, use the information on Form 1095C to report the months of coverage you did have, To review all of your health insurance entries From within your TaxAct return (Online or Desktop), click Federal On

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Www Northwestern Edu Hr Documents Benefits 1095 Faq Pdf

Reporting of ICHRA in Line 14 Codes of Form 1095C for On , the IRS released a Form 1095C draft, which adds new 1095C codes from 1L to 1S for employers to indicate the method used to determine their ICHRA plan's affordability Click here to learn more about ICHRAIn the month of November , the IRS released a revised version of Form 1095C, which adds new codes from 1L to 1S for employers to indicate the method used to determine their ICHRA plan's affordability Click here to learn more about ICHRA The codes are mentioned here Let ACAwise handle your ACA ReportingForm 1095C () Page 2 Instructions for Recipient You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, Part

2

Form 1095 A 1095 B 1095 C And Instructions

Employers have until January 31 to send the form to their employees Thus, a 1095C form will be sent in early January 21No Only you will receive the Form 1095C We will not provide a separate form to others covered on your plan, even those who do not reside with you As the recipient of the form, you

1095 C Form 21 Finance Zrivo

Questions Employees Might Ask About 1095 C Forms Bernieportal

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Www Opm Gov Healthcare Insurance Fastfacts Health Coverage Forms Fast Facts Annuitants Pdf

1095 C Reporting Determining A Company S Ale Status Integrity Data

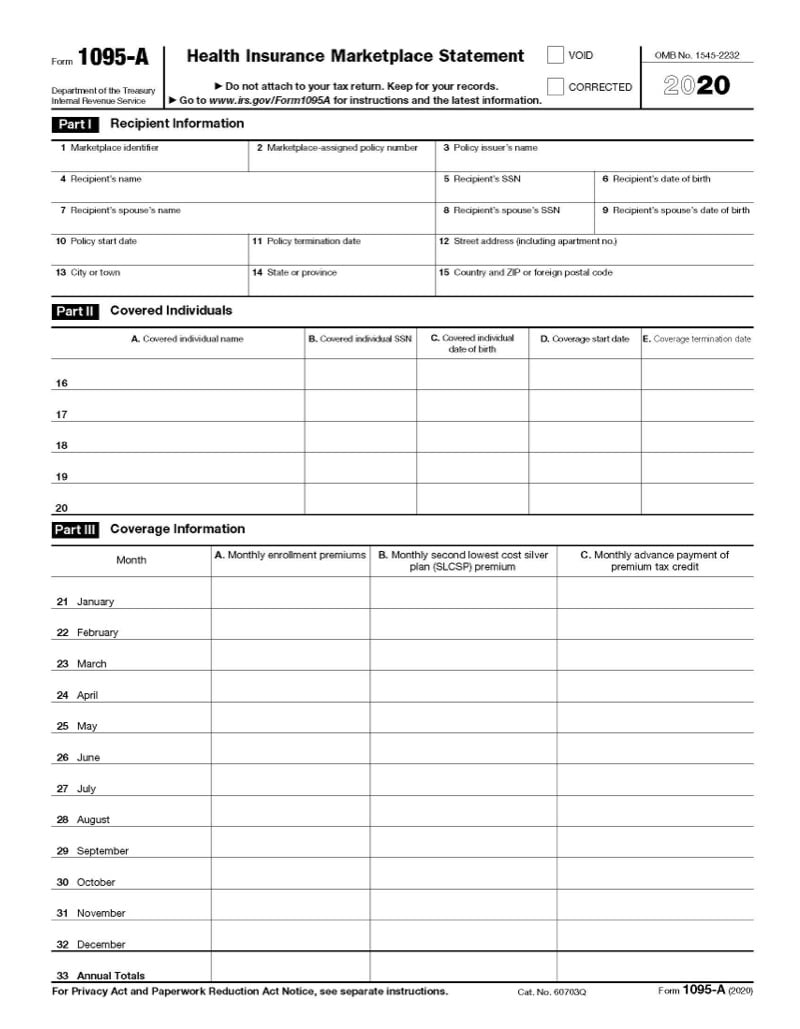

Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Form 1095 C Forms Human Resources Vanderbilt University

2

1095 C Employer Provided Health Insurance Offer And Coverage Form 250 Sheets Pack

Www Integrity Data Com Wp Content Uploads 19 11 Integrity Data Aca Form Distribution Faqs Pdf

W 2 Laser Federal Irs Copy A

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

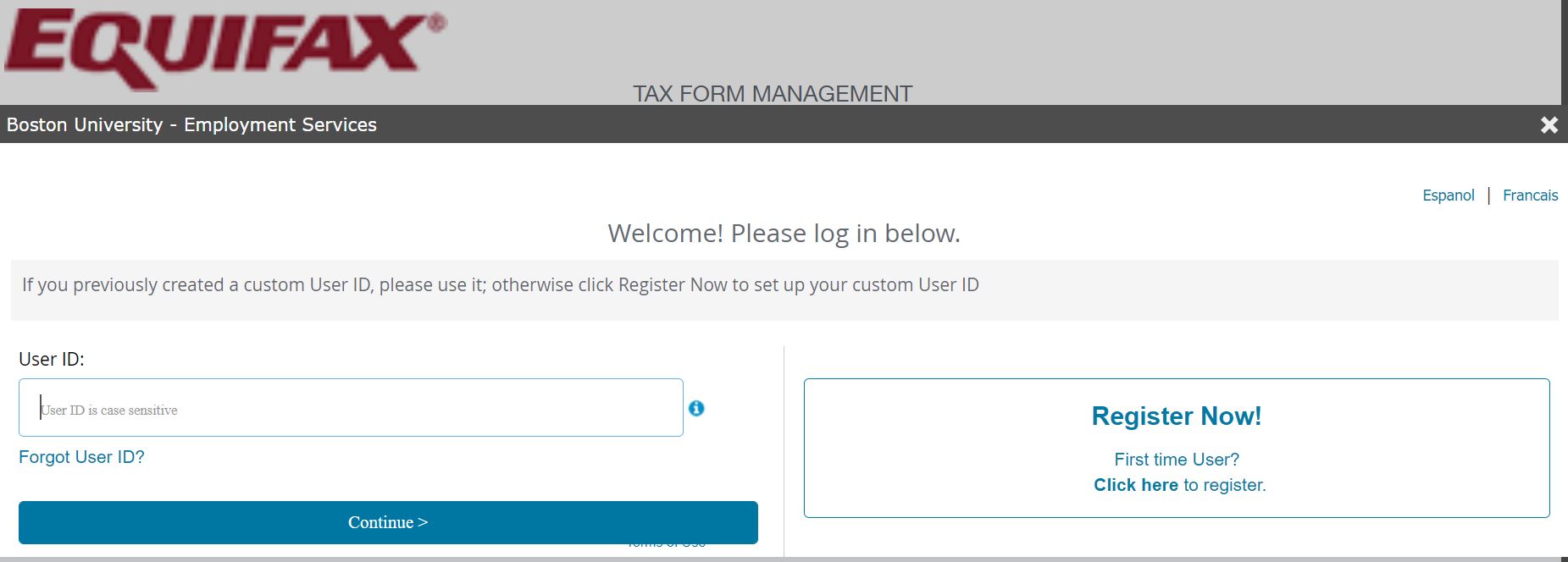

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Www2 Illinois Gov Cms Benefits Stateemployee Documents 1095 Faqs Pdf

2

1095 C Employer Provided Health Insurance Offer And Coverage Form 14 Pressure Seal Ez Fold 500 Forms Carton

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

1095 C Form 21 Irs Forms

Www Ftb Ca Gov Forms 35c Publication Pdf

Tmlhealthbenefits Org Forms Tml Displaydoc Aspx Doc Id 694 Form Webinar

Www Schoolcare Org Uploads Files Video Transcript Irs Reporting Updates Part 2 Pdf

Your 1095 C Tax Form For Human Resources

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Your Tax Forms W 2 And 1095 C One Spirit Blog

Updates To Form 1095 C For Filing In 21 Youtube

2

2

Changes In 21 Aca Reporting Health Insurance Coverage Employment Health Plan

2

Irs Extends Deadline For Furnishing Form 1095 C Extends Good Faith Transition Relief Alera Group

Aca Reporting Services Dayforce Ceridian

2

2

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Tax Form 1095 A Frequently Asked Questions

What You Need To Know About Aca Annual Reporting Aps Payroll

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Aca Code Cheatsheet

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

2

1099 Misc Form Copy C 2 Recipient State Zbp Forms

Www Irs Gov Pub Irs Pdf F1095b Pdf

2

2

Instructions For Forms 1095 C Taxbandits Youtube

The New 1095 C Codes For Explained

Amazon Com Form 1095 C Health Coverage And Envelopes With Aca Software Includes 6 1094 B Transmittal Forms Pack For 100 Employees Office Products

3

1094 C Transmittal Of Employer Provided Health Insurance 1095c Coverage Info Returns 3 Sheets Form 100 Forms Pack

1

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 62 Premium Tax Credit Definition

Line By Line Instructions To Complete Form 1095 C Blog Acawise Aca Reporting Solution

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

14 1095 C Pressure Seal Z Fold

1095 C Faqs Mass Gov

Irs Extends Distribution Time Limit For Form 1095 Anderson Jones

Irs Health Coverage Reporting Form 1095 C Examples For Youtube

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Form 1095 C The Aca Times

Aca Forms

Hr Jhu Edu Wp Content Uploads 19 06 Aca 1095faq Pdf

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

Aca Forms

Trisure Corporation Legal Alert Irs Extends Deadline For Furnishing Form 1095 C To Employees Facebook

Your 1095 C Tax Form For Human Resources

1095 C Irs Employer Provided Health Insurance Offer And Coverage Continuation Form Landscape Version 25 Sheets Pack

Form 1095 C H R Block

2

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Your 1095 C Obligations Explained

Info Nystateofhealth Ny Gov Sites Default Files English aptc cover letter Pdf

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

19 Aca Reporting Timeline Pomeroy Group

1

Assets Kpmg Content Dam Kpmg Us Pdf 10 622 Pdf

Form 1095 C Released New Codes New Deadlines

0 件のコメント:

コメントを投稿